Renters Insurance in and around Lee's Summit

Lee's Summit renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Lee's Summit Renters!

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or house, renters insurance can be one of those most reasonable things you can do to protect your stuff, including your coffee maker, clothing, linens, furniture, and more.

Lee's Summit renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Why Renters In Lee's Summit Choose State Farm

Renting a home is the right decision for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

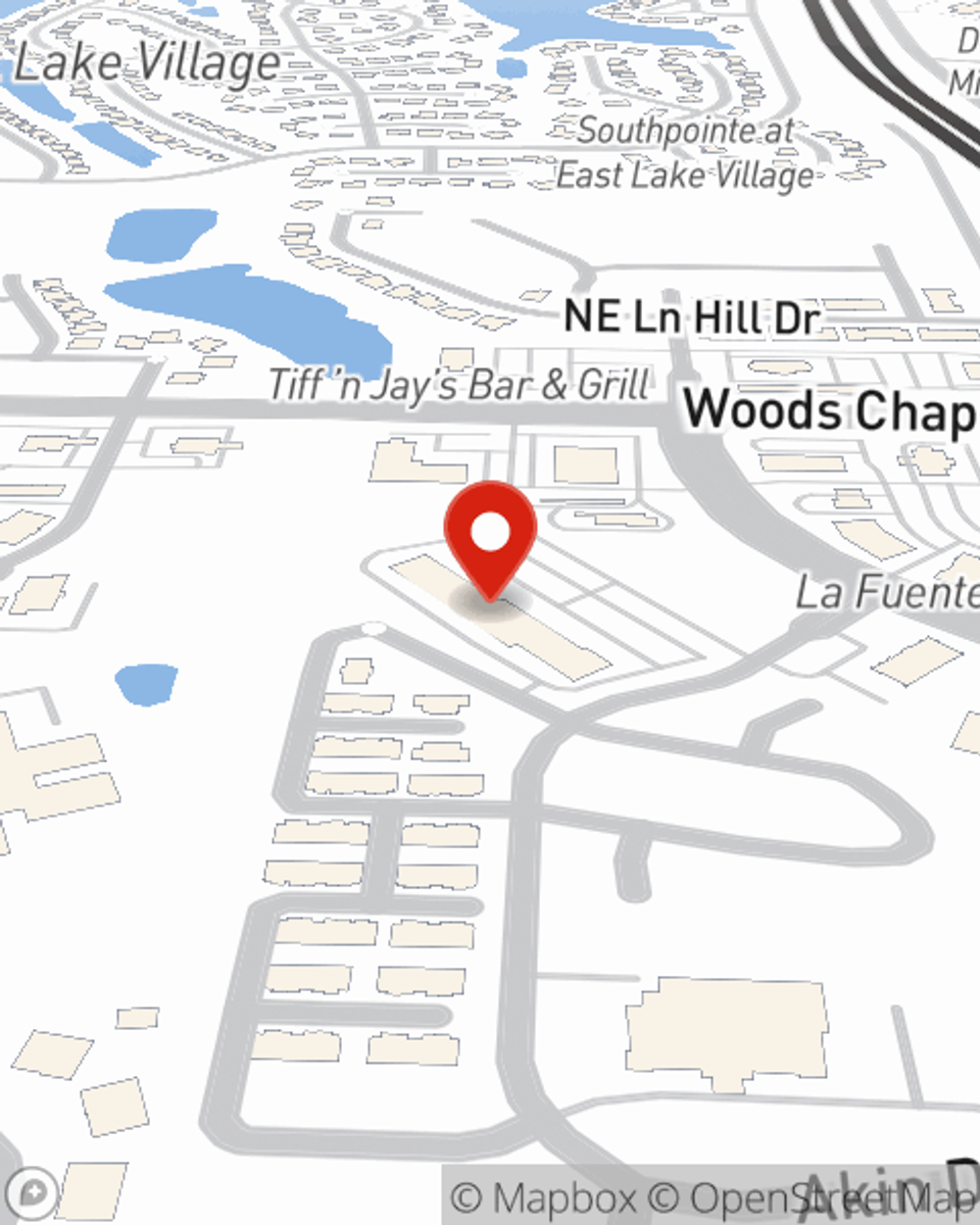

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Lee's Summit. Call or email agent Bret Farrar's office to discover a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Bret at (816) 333-4445 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Bret Farrar

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.